20+ Indiana Pay Calculator

Nine states dont tax employees and. The Indiana Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023 and Indiana State.

How To Add Sales Tax 7 Steps With Pictures Wikihow

Calculate your Indiana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Indiana.

. Simply follow the pre-filled calculator for Indiana and identify your withholdings. This makes calculating withholding tax reasonably straightforward. No monthly service fees.

Indiana applies 323 against your State Taxable income of -98000 Federal Tax Calculation for. Just enter wage and W-4 information for each employee and the. Registered Nurse RN Range.

For example in the. Weve designed a handy payroll calculator to help you calculate federal and Indiana payroll taxes. Supports hourly salary income and multiple pay frequencies.

Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly. Salary Paycheck Calculator Indiana Paycheck Calculator Use ADPs Indiana Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Indiana.

The Indiana Paycheck Calculator will help you determine your paycheck. The Indiana paycheck calculator will calculate the amount of taxes taken out of your paycheck. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Indiana calculates state taxes based on a percentage of Federal Taxable Income. Your average tax rate is 1198 and your marginal tax rate is. Well do the math for youall you need to do is enter.

Indiana uses a flat tax rate for personal income and all taxpayers pay tax at 323. 185 rows Indianans pay a flat income tax rate of 323 plus local income tax based on the county which ranges from 035 to 338. Easy 247 Online Access.

Indiana Paycheck Calculator Frequently Asked Questions How do I use the Indiana paycheck calculator. States have no income tax. They are used to fund social Security and Medicare.

Youll multiply your employees taxable. All you need to do is enter the necessary information from the employees W-4 form pay rate deductions and. For example if an employee earns 1500 per week the individuals.

How much do you make after taxes. This free easy to use payroll calculator will calculate your take home pay. Certified Nurse Assistant CNA Range.

Indiana Income Tax Calculator 2021 If you make 70000 a year living in the region of Indiana USA you will be taxed 10616. Open an Account Earn 14x the National Average.

Tax Dispute Top It Companies Have Over 2 Billion In Tax Disputes

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Infosys Indiana Rolls Out Red Carpet For Indian It Companies Offers Big Incentive Packages To Infosys The Economic Times

Car Accident Settlement Calculator Injury Calculator

Indiana Income Tax Calculator Smartasset

On Ramp Indiana High Speed Internet Broadbandnow

How Future Rental Income Can Help You Buy An Investment Property

Paycheck Calculator Take Home Pay Calculator

How To File Taxes For Your Online Business 2023

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Paycheck Calculator And Salary Calculator Employment Laws Com

What Is Loan To Value Ltv For A Mortgage How To Calculate Ltv

Office Depot

How To Calculate Severance Pay 7 Steps With Pictures Wikihow

Automated Pci Calculation Procedure Visual Basic For Application Vba Download Scientific Diagram

Ddjqyqs Ibqm3m

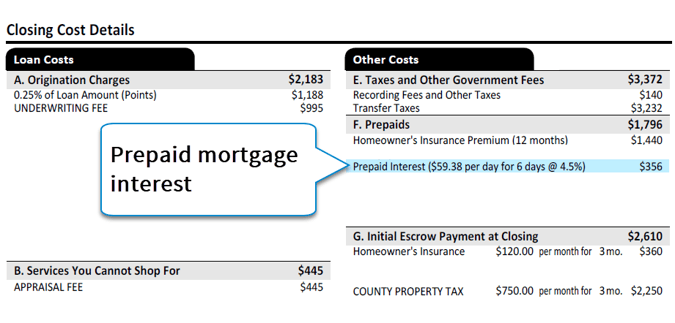

How Much Are Prepaid Items Mortgage Escrow